Despite Bitcoin price volatility, factors point to BTC’s long-term success

Bitcoin’s volatility persists after the halving, but surging ETF inflows and thriving L2 ecosystem growth fuel long-term optimism.

Bitcoin’s long-awaited halving event concluded on April 20, cutting the asset’s block mining reward from 6.25 BTC to 3.125 BTC.

It was the fourth time Bitcoin has undergone a halving since its inception, and substantial price surges have historically followed these events.

After the 2012 halving, Bitcoin’s value skyrocketed by an impressive 9,500%, while the 2016 halving saw a 3,000% increase over the following year. However, the price rally following the 2020 halving was more modest, with Bitcoin’s value rising by only 650%.

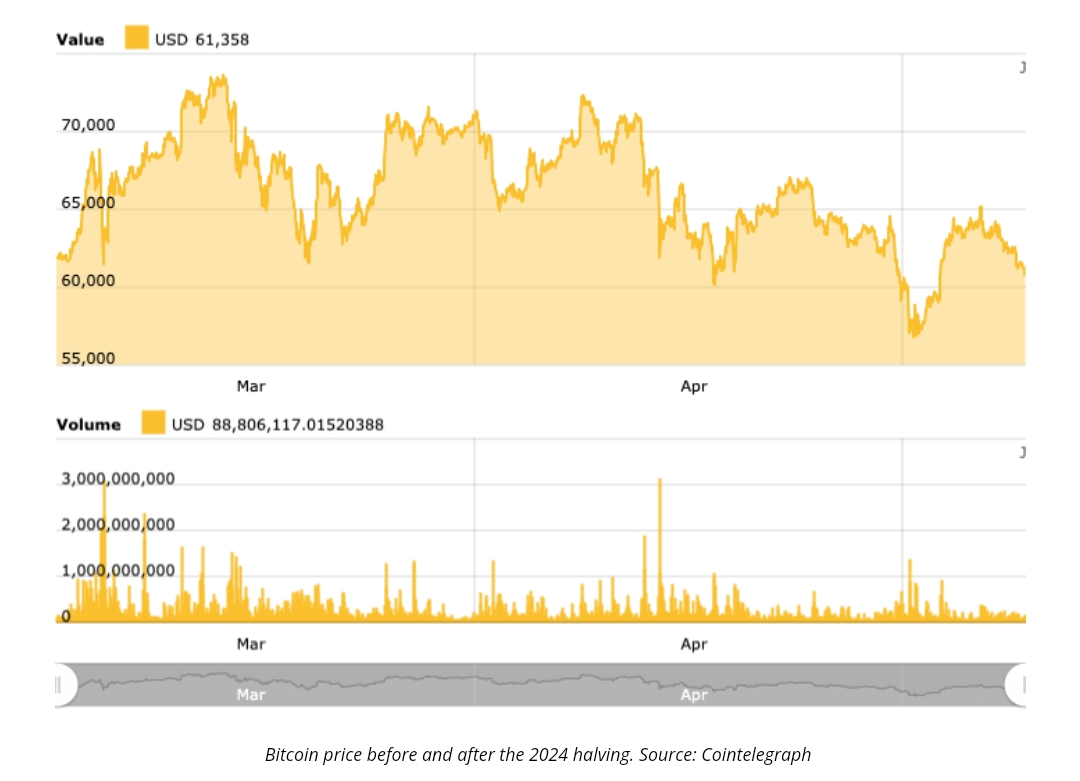

This time around, Bitcoin experienced a 110% price increase before the event amid immense volatility.

During the week before the halving, Bitcoin’s value dipped 17% from $72,000 to $60,000.

Moreover, as can be seen from the chart above, after the halving, Bitcoin’s price has not risen or stabilized but continued to wobble — rising to a price point of $67,000 on April 24, only to drop back to $62,500 just 72 hours later.

On this issue of volatility, asset management company Bitwise recently advised investors to proceed with caution, suggesting that the halving was a “sell the news” event. JPMorgan and Deutsche Bank analysts seemed to concur with this sentiment, projecting that BTC could reach as low as $42,000 in the coming weeks.

ETF inflows suggest a price uptick for BTC

Since their launch in January 2024, United States-based spot Bitcoin exchange-traded funds (ETF) have seen remarkable growth. For example, BlackRock’s iShares Bitcoin Trust (IBIT) enjoyed a monumental 71-day streak of daily inflows, racking up nearly $15.5 billion in assets before finally recording zero net inflows on April 24. This milestone placed IBIT among the top 10 longest inflow streaks for any ETF in history.

Despite IBIT’s pause, other Bitcoin ETFs, such as Fidelity’s Wise Origin Bitcoin Fund and ARK Invest’s ARK 21Shares Bitcoin ETF, have continued attracting decent inflows over the same period. In fact, since their launch, U.S. spot Bitcoin ETFs have accumulated $12.3 billion in assets under management.

hat said, it is important to acknowledge that inflows have somewhat slowed in the second quarter of 2024 compared to the first quarter’s peak of $6 billion in February. However, analysts remain bullish on continued demand. Matt Hougan, chief investment officer for Bitwise, believes BTC ETFs are “just getting started,” citing untapped potential from institutions still conducting due diligence and the lack of availability on major wealth management platforms like Morgan Stanley and Merrill Lynch.